Where Should an Offshore Company Open a Bank Account?

An Offshore Bank Account is a bank account in a country other than the one you are an inhabitant of. Offshore bank account or international bank account, by and large, alludes to accounts opened in financial havens like Luxembourg, Cyprus, Caribbean islands, Switzerland, and so forth.

Strategy & Development Agencies in Seattle

Seattle’s Gravity Creative is a small branding agency Seattle-building creative agency with a relatively long reach. The company has an excellent portfolio of work for its roster of regional, national, and international brands such as Microsoft, Taco Time, and PetSmart. Gravity Creative aims to ignite brands with its proven strategy. The firm provides its clients with a range of branding services such as digital services, packaging, and design services to produce award-winning brands.

The word ‘offshore’ was begun in Great Britain and alluded to banks that are not arranged there. Perhaps as much as 50% of overall capital moves through offshore banks.

These banking jurisdictions offer critical security, more grounded cautious enactment, and international openness of your funds. Much of the time, people use international banking for asset security from legitimate authorities when joined with an offshore trust or company.

At the point when you bank on an international level, you are taking advantage of different preferences of offshore jurisdictions. An offshore bank account can be a fantastic privacy mechanism.

To lift your financial protection, one opens the bank account for the sake of an offshore financial company. The tax benefits you treasure relies upon your nation.

Since working costs usually are lower, international banks now give higher interest rates than domestic banks. Offshore banks can offer security if you live in a country with shaky cash or political climate.

Various people have loved ones in far off countries. Offshore bank accounts are likewise the right spots to hold money if you have to send them advantages.

You may need to avoid passing on a great deal of money with you on the excursion. On that occasion, you can pick an offshore bank account.

Follow the guide to learn about setting up an offshore company as well as opening an offshore bank account to enjoy the benefits.

Oregon Makes a GoodBackdrop

I guess you will find these photos a lot of fun because they show a lot of picturesque scenery and Oregon makes a good backdrop. But there is something even cooler about traveling Oregon’s advertising. As the commercial ends, they say goodbye to Oregon by posing as tourists in Oregon and then driving off into a car full of Oregon locals. You could imagine anyone from around the state packing up and heading north.

In which nations may bank accounts be opened for offshore companies and people?

The geographic area is one of the most significant highlights of any bank and is one of the parts of the bank’s notoriety. Typically, the region of the bank involves prime enthusiasm for clients wishing to open an account.

Nonetheless, your bank’s decision should not be directed by the nation’s notoriety alone or how your foreign partners are situated in that nation. This may make you settle on the wrong choice, and you should work with a bank that doesn’t meet your prerequisites.

Here’s a list of the popular offshore jurisdictions that are widely selected for opening an offshore bank account.

You may need to manage a deficiently significant expense of banking administrations and biases against the jurisdiction where your company has been registered. You may likewise find that the bank’s workers’ methodology concerning the customer’s needs may also contrast from that in your own nation.

The geological area of a bank ought to be considered. Nevertheless, the first and most significant basis that you should remember is your account’s right working and the bank’s proper specialization.

Which bank is most appropriate for opening an account for an offshore company?

Directly from the start, it must be said that there is nothing of the sort as an ideal account, similarly as there are no ideal banks or ideal customers. That is why it is advantageous to search for a bank where you may open an account generally fitting your requirements.

In case you need an account for your company’s business, the odds are that there will be continuous exchanges on the account. Subsequently, in the primary occurrence, you ought to pick a bank where the quantity of trades, either internal or external, isn’t restricted.

While picking a bank, you should likewise consider the following: Where will the account opening process occur? Are there any necessities for the initial deposit and ‘minimum balance’ on the account? Does the bank work with cryptocurrencies such as the rouble? Do you think the bank’s rates and duties are worthy? Will you need to present any reference letters, and how convoluted is the entire account opening process in general?

What currencies are accessible?

Banks offer accounts in various currencies. They usually are Dollar accounts or Euro accounts. However, it is likewise conceivable to open accounts in Swiss francs, pounds sterling, or different monetary standards.

The strategy is as per the following: your bank opens one multi currency account or a few accounts, each with their own number for specific money. You can generally send an installment request for the move of funds in a currency different from the currency of your account.

For this situation, installment will be made dependent upon the interior conversion standard at the installment date.

Kinds of plastic cards provided by banks

Mastercards are offered to the customers of practically any bank. However, the terms and states of the issue will be unique.

You may get your card when the account is opened, in the wake of having finished the important application form during a meeting with the bank’s official, or you may get the card at a later stage if it is to be given under unique conditions. There are Swiss banks which won’t issue Mastercards except if there is a sum surpassing, state, USD 300,000 stored on the customer’s account.

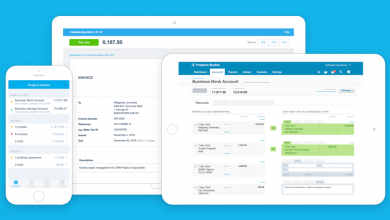

Would you be able to monitor your corporate account through the internet?

Truly. These days, e-banking is a broadly spread assistance that empowers you to rapidly get account data on the web and screen the exercises on your account. At your own accommodation, you may check the balance on your account and make and send any installments with no fax or telephone interchanges with the bank.

Who can work corporate accounts?

Corporate accounts can be opened, worked, and shut by appropriately authorized people only. In the primary occasion, such people are the company’s director, and, including, the company’s attorney, that is, the holder of a power of attorney with the ability to open and close accounts included in that.

You can read more about Best Sunglasses trends for women